After the Sale & Follow-Up

After the Sale: Your Path to Getting Paid

Closing the deal is just the beginning. Follow these critical steps to turn applications into issued policies and commissions in your bank account.

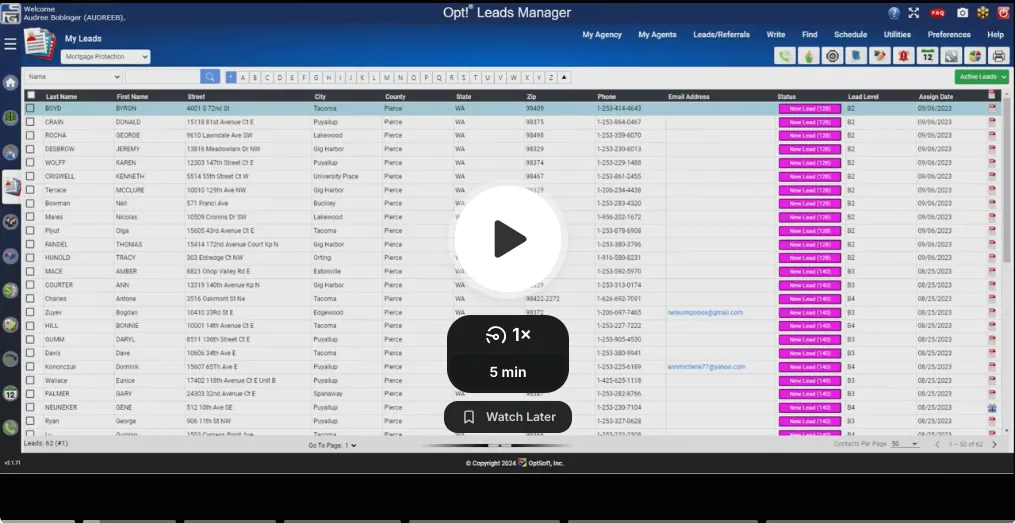

Record Every Sale in Opt!

If it's not in Opt!, headquarters can't track it, and you won't get credited for your hard work.

Opt! is Your Official Sales Record - Where headquarters tracks every lead and sale you work.

Get Credit for Your Production - Ties each policy back to you for proper commission tracking.

Your Leadership Team Monitors Here - Agency owners use OPT to track your progress and wins.

It Takes a Few Minutes — Do It Immediately - Record your sale right after the client signs.

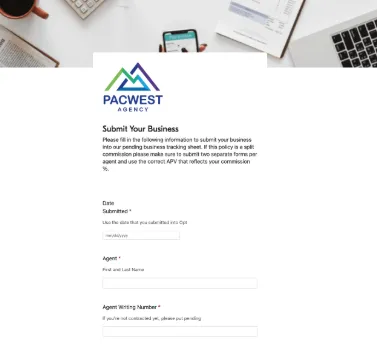

Submit Your Sales to Airtable

Airtable is how PacWest tracks your individual production. Your agency owner and mentor use this to monitor your progress and provide support.

Every sale you make needs to be recorded in Airtable so your leadership team can see your pipeline, celebrate your success, and help you when needed. Select your agent portal below and submit both pending applications and issued policies.

Darin Stubbs Base Shop

Bobinger Agency

Mendicino Agency

🚨 Critical Reminder

Submitting your applications will not get you paid.

Getting those policies ISSUED will get you paid!

You don't earn a commission until the policy is issued and your client is officially covered. Stay on top of your pending applications and follow up with carriers until each one is issued.

Multiply Your Success Through Referrals

Your best clients know other people who need insurance. Ask for referrals every time, and watch your business grow exponentially.

Pre-Qualified and Warm - Referrals come with built-in trust. They're easier to close because your client has already vouched for you.

Cost-Free Lead Generation - Every referral is a free lead you didn't have to purchase. More referrals mean higher profit margins.

Build a Self-Sustaining Business - Top agents generate 30-50% of their business from referrals. Make it a standard part of your delivery process.

Earn 40% Commissions with FIF Referrals

FIF (Financial Independence Formula) training teaches you to identify clients who need advanced financial solutions, and earn massive referral fees without extra licenses.

Expand Your Service Offerings - Learn to ask questions that uncover opportunities in 401(k) rollovers, annuities, debt reduction, and wealth protection.

Earn Without Extra Work - Simply refer qualified clients to an FIF professional and earn up to 40% commission. No additional licenses needed.

Deepen Client Relationships - Position yourself as a trusted financial advisor, not just an insurance agent. This leads to more referrals and repeat business.

Additional Resources

Complete Living Trust Option

Help your clients protect their assets and legacy with a complete living trust. This value-added service strengthens relationships and opens doors to family referrals.

Spreadsheet for Tracking Clients

Stay organized and never miss a follow-up. Manage your pipeline, track pending applications, and ensure no client falls through the cracks.

FIF Training

Ready to unlock 40% commissions and expand your financial services? Get started with FIF training today.

Manage Your Pending Apps Like a Pro

Pending applications don't pay commissions. Be proactive about following up with carriers to get your policies issued and your clients protected.

When can I check on my application status?

For e-apps, you'll see the initial status immediately upon submission. Most carriers update their systems within 24 business hours. If you submitted a paper application, check with the carrier after 3-5 business days.

What if my application is not on the carrier's site?

If you're contracted with the carrier and 24 business hours have passed but you don't see your application online, call the carrier directly. They can confirm receipt and let you know if any documents are missing.

What if the carrier doesn't have my application?

First, check online and then call the carrier to confirm. If they confirm they never received it, notify your Agency Owner immediately so they can help you resolve the issue and resubmit if necessary.

My application has pending issues, now what?

Take action immediately. Do everything you can to resolve it quickly. If you're unsure how to handle something, contact the carrier's support team or reach out to your mentor for guidance.

How often should I check pending?

Check your pending applications daily until each policy is issued. This proactive approach prevents delays, keeps clients informed, and gets you paid faster.